Posts

Look at the financial’s cellular deposit policy to know the exact restriction. The fresh software spends encoding to safeguard your data and keep maintaining their put secure. Very banks enable it to be mobile dumps for personal inspections, business monitors, cashier’s checks, and regulators checks.

Verification away from a cellular deposit isn’t a promise it acquired’t be returned. In case your cheque bounces since the person who wrote it doesn’t have enough money in their membership to cover they, their cellular put was reversed. Placing a magazine cheque thru cellular put can be as safer and you can safe while the bringing the currency to a branch. The newest Cheque Clearing for the twenty-first Millennium Work allows banking companies in order to deal with substitute mobile put cheques if they’re also the fresh courtroom same in principle as an actual cheque. That’s exactly what secluded deposit bring allows—the brand new replacing away from an electronic digital type of your own cheque for a good report you to.

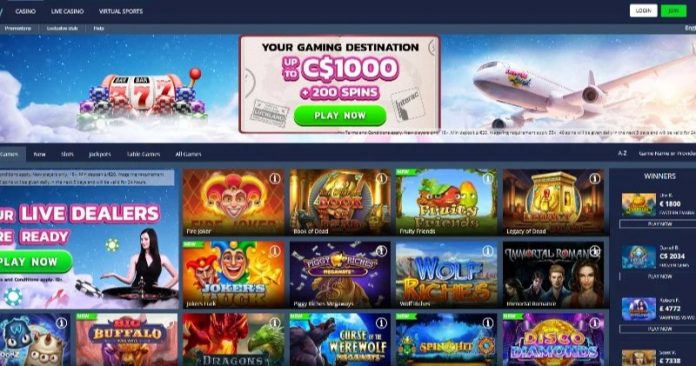

Researching Alternative Deposit Choices at the Gambling enterprises to pay because of the Cellular Statement

Mobile consider deposit works by using a help titled secluded deposit get. Basically, secluded put get allows you to get an electronic image of your own view. Your financial business will likely then assemble the pictures and techniques your deposit. Your next step is always to recommend the look at once you’ve affirmed it falls inside your bank’s deposit constraints. Definitely keep sign in a safe area up until the thing is that an entire put count listed in your account’s prior/latest deals.

“Eventually, (people) will be using a good shredder,” says Scott Butler, economic coordinator with advisory business Klauenberg Later years Choices in the Laurel, Maryland. You don’t want someone getting hold of your own take a look at and you may seeking dollars they otherwise put it. Continue reading for much more outline on what’s doing work in each step of the process first off deposit their checks by the cellular phone. Brooke Banks is a personal finance creator devoted to credit, personal debt, and smart-money government. She helps subscribers understand the rights, make greatest borrowing from the bank, and make pretty sure economic choices having clear, fundamental advice. Mobile deposit lets you fill out pictures of your own front and back of your recommended, eligible take a look at.

While the amount of professionals reaching because of their cell phones to own winning contests and amusement is on the rise, the fresh and you can shorter commission steps are growing. A routing number encourages purchases including inter-bank transmits and head dumps. Navigation numbers disagree to have Wells Fargo Examining and you may Savings membership, Personal lines of credit, and you may cord transfers.

Pay Because of the Cellular telephone Cellular Casinos

Depositing thru cellular phone borrowing is achievable when the a site web good prepaid cellular phone range makes it possible for get better payments. In cases like this, you’ve got already covered the mobile operator’s characteristics and use element of you to definitely harmony to cover a good put in the an online gambling enterprise. On one hand, it’s simpler — you’lso are spending-money you’ve already purchased your own cellular phone, so that you won’t overspend.

- We in addition to take a look at support programs, such as the one to at the Trino Gambling establishment, which includes 8 themed VIP profile with up to 20% cashback.

- As the restrict win is normally limited by simple odds (x33 to possess a single amount choice), bonus-element video game is yield earnings out of x100 or even x500.

- Mobile phone statement sports betting totally supporting the brand new push to the responsible gambling.

- Beneath your trademark, you’ll also need to produce certain type of the conditions “to own cellular deposit merely,” depending on what your lender otherwise borrowing from the bank union needs.

If you found a blunder content, take some time to ensure your’ve recommended the newest look at, closed the complete name, and you may affirmed the fresh deposit amount and you can membership info. In case your deposit consult however doesn’t undergo, you can even imagine calling your financial organization to possess advice. When you’ve additional the fresh deposit number, it’s time and energy to bring pictures of your own look at. For ideal results, put your review a flat, dark-background surface to change clarity. Up coming, smack the cam symbol on the mobile app to start the newest camera.

Pay-by-cellular choices well match LeoVegas’ dedication to benefits, enabling trouble-100 percent free transactions just in case you like gambling on the move. While the a friend bank account manager, you’ll shell out zero monthly maintenance otherwise overdraft charges, and you also’ll discover month-to-month Automatic teller machine commission reimbursements and early direct put access. You could put monitors via the Friend mobile application, and you will fund come relatively quickly. Cellular cheque put will likely be a convenient way to handle places in order to a chequing, discounts otherwise currency business membership. There are lots of banking companies and borrowing from the bank unions that offer mobile cheque deposit while the an option.

If you’d like to manage otherwise change your standard membership, visit the Deposit to help you dropdown and pick the newest account you want to make your default, then find Get this membership my personal default. Playing should be fun, not a source of fret otherwise damage. Should you ever getting they’s getting an issue, urgently contact a helpline on your nation to possess immediate support. Preferred choices in order to Aviator already is Big Bass Splash, Spaceman by Pragmatic Play, and you will JetX by the Smartsoft.

The brand new small answer is one cellular cheque put is as safer as your other online and cellular financial features. Should your bank plans to place a hang on the new put, you may also found a notice before finalizing a mobile cheque put. You’d following have the choice to keep to the mobile put or take the newest cheque in order to a branch alternatively. Cheque with your lender observe the insurance policy to have holding dumps as well as how rapidly your own cellular cheque deposits will be obvious. Following, make use of your app’s diet plan to locate in which cellular dumps are found.

Actually novices can be fill its gaming account within a few minutes by the verifying the order via an enthusiastic Sms code or some other strategy. One of the first spend from the cell phone functions try Zimpler, and that launched this service in the 2016 around the European countries, such as the United kingdom, Sweden, Finland, or any other nations. Which have Zimpler, we provide the quickest fee confirmation thru Text messages code, and that claims a top security top when making deposits from the on line gambling enterprises. Now, really people want to enjoy from their mobiles, establishing bets at any much easier go out. That’s as to the reasons the advantages is recording the new expanding pattern of pay because of the cellular phone casinos, that provide repayments through cell phones.

Meanwhile, e-bag distributions are mostly completed in less than 24 hours. Concurrently, Jackpot Cellular helps multiple-money deals — you might put and withdraw inside the GBP, EUR, and you may USD. With Wells Fargo Cellular put (“cellular put”), you possibly can make a deposit in to your own eligible examining or savings account by using the Wells Fargo Mobile software. You could potentially promote a check to possess cellular deposit by composing “For mobile put only at financial name” below your trademark on the back of your take a look at.